Indexed Universal Life: Protection, Retirement and Health

Discover the potential benefits of an Indexed Universal Life

Indexed Universal Life

Indexed universal life insurance is more than most people might expect. It provides an income tax-free death benefit, but it can also offer much more. With indexed universal life insurance, you can create a tax-efficient, diversified retirement strategy with the potential to accumulate cash value that can be accessed for supplemental retirement income, a new home, college tuition or other goals with additional potential benefits of long-term care, chronic illness and legacy solutions.

HOW IUL WORKS

You pay premiums as you like

As long as your policy is properly funded, you can pay your policy’s premiums when you want, and in the amount you choose. This can give you the flexibility to address other financial needs or unexpected expenses.

Your accumulation value grows tax deferred

Your policy’s accumulation value can earn interest in two ways – at a predictable, fixed rate, or based on the annual positive return of an external market index. When interest is credited, it’s locked in and continues to grow tax-deferred until you take money out of your policy. That gives your accumulation value more compounding potential.

Your accumulation value is protected

If you choose the indexed interest option, any indexed interest you receive is based on changes in an external index – but you’re not actually participating in the market. That means your accumulation value can’t go down due to market volatility. (However, fees and charges will still reduce the policy’s value.)

You can access your cash value

Down the road, you can access your policy’s available cash value through income-tax-free loans and withdrawals1 for any purpose – such as helping fund a college education, supplementing your retirement income, or even helping cover a medical expense. Because loans and withdrawals will reduce your policy’s cash value, you’ll want to carefully monitor your policy’s values and make sure your policy is properly funded so it doesn’t lapse.

Tailor your policy to your needs

In exchange for an additional cost (and with some restrictions, including underwriting), you can add optional riders that offer chronic illness benefits, premium payment waivers, extra term coverage, and more. Your financial professional can help you determine which rider(s) may make sense for your unique financial needs, and also explain the cost(s).

Leave a legacy

Your beneficiaries get a death benefit that is generally income-tax-free. It can help cover funeral costs, medical bills, pay the mortgage, replace your income, and even ensure the continuity of a business if you pass away.

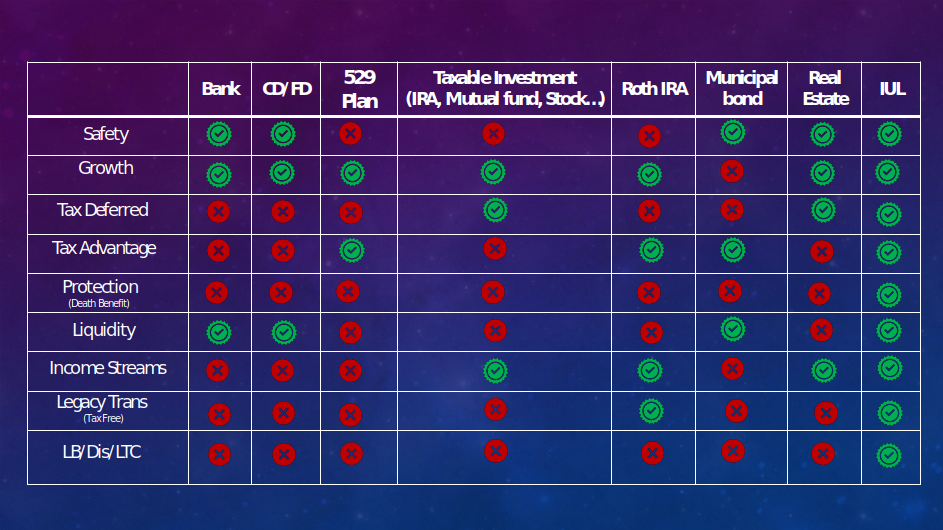

HOW AN IUL CAN ENCHNACE YOUR RETIREMENT PORTFOLIO

WHY CONSIDER AN IUL WHEN PLANNING FOR RETIREMENT ?

Completion Risk

By including IUL as one of your retirement planning tools, if you die prematurely, the life insurance contract pays your loved ones the death benefit you chose, leaving them more financially secure.

Taxation

With an IUL, an amount loaned out of your life insurance policy is not treated as "paid out of the policy" and is therefore not included in taxable income, as long as your policy remains inforce.

Opulence Planners does not offer tax or legal advice. Consult a tax professional regarding your specific situation

Funding Amount

With an IUL, you have complete freedom to choose your death benefit and the associated premium amount to build the cash value you desire on a tax-advantaged basis.

Market Risk

With an IUL, your cash value can be credited with an interest rate based on increases in a market index, with protection from market index decreases.

IS IUL RIGHT FOR ME?

IUL as a solution is not a one size fits all. The major benefit of using an IUL in your retirement planning is the benefit of choice. IUL owners enter retirement with an additional asset that is guaranteed not to lose value in down markets and could significantly outperform other investments with similar risk profiles. Using an IUL for retirement planning also offers the owner of the IUL the ability to select which account to pull their necessary retirement income from, lessening your tax burden in the future.